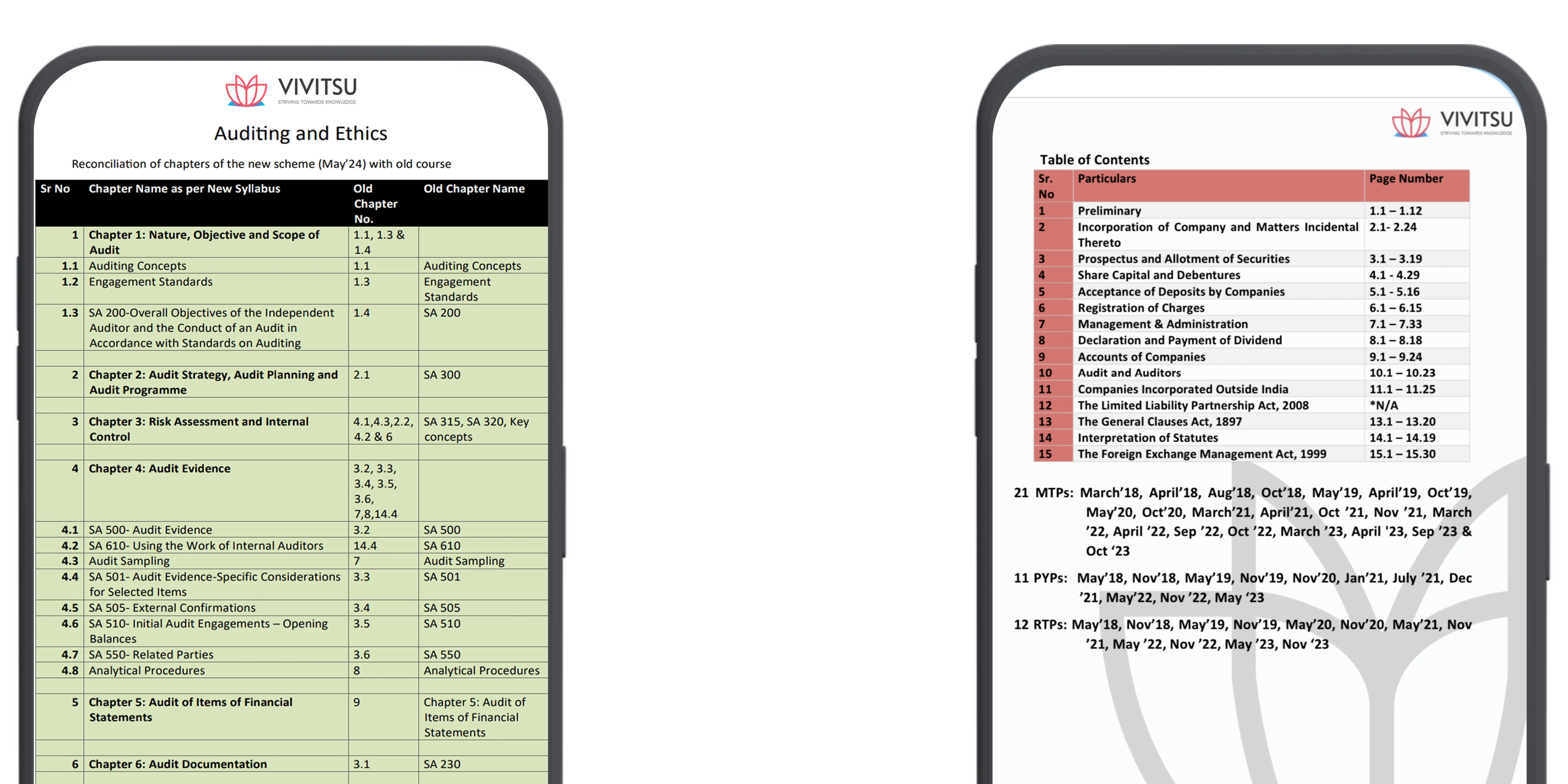

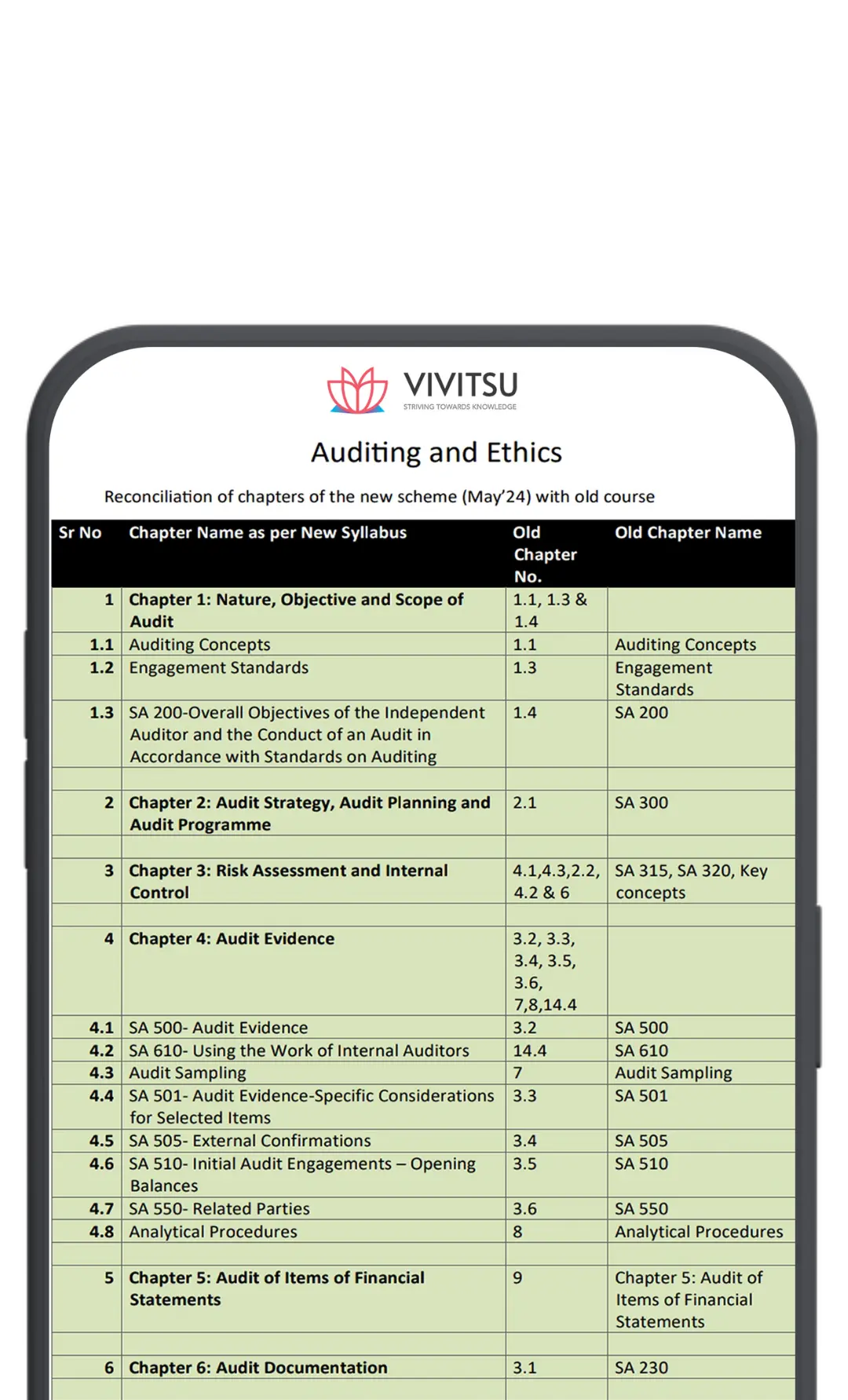

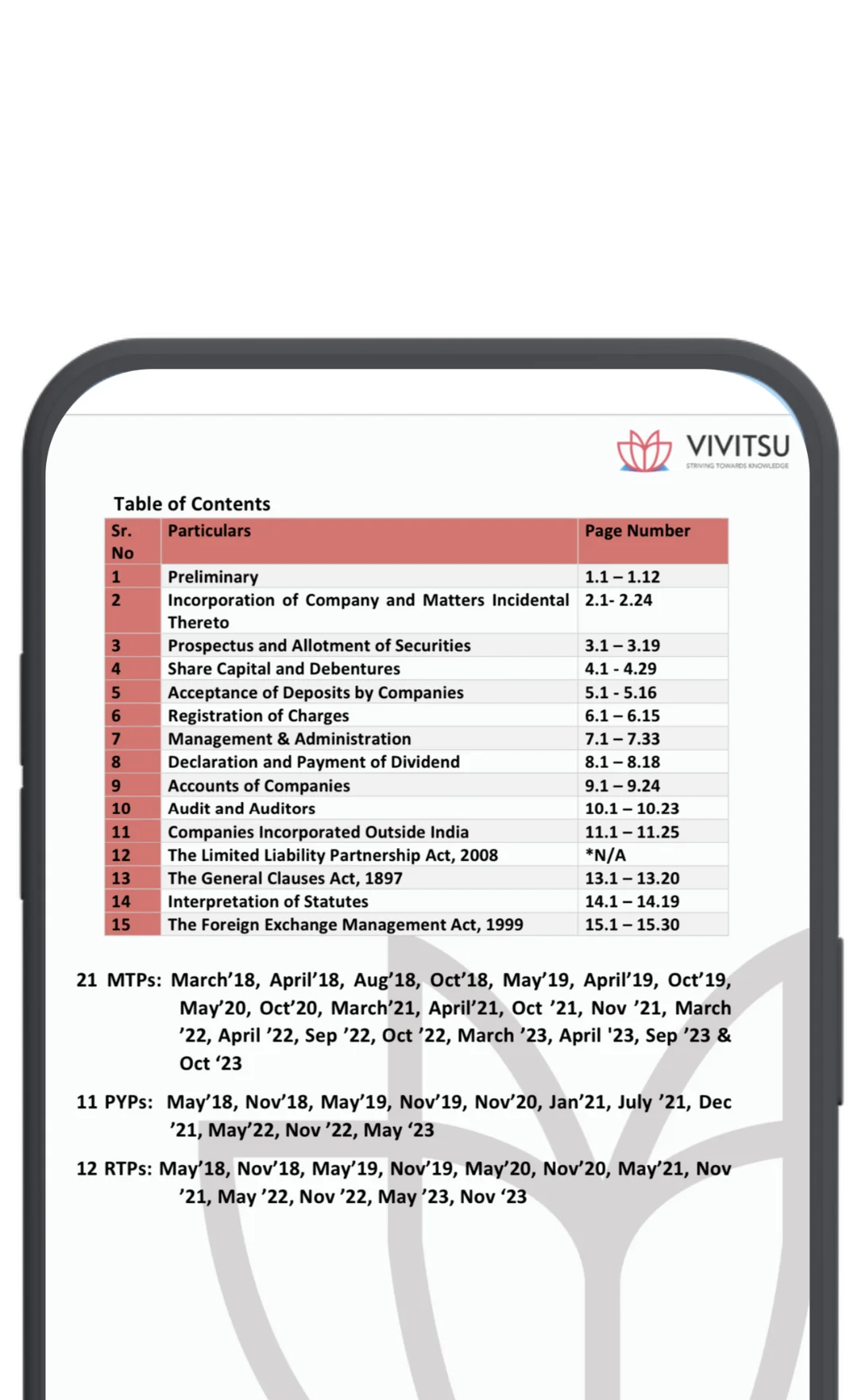

CA Intermediate Compilations for Sept'24/Jan'25

Applicable for New Scheme

Applicable for New Scheme

+

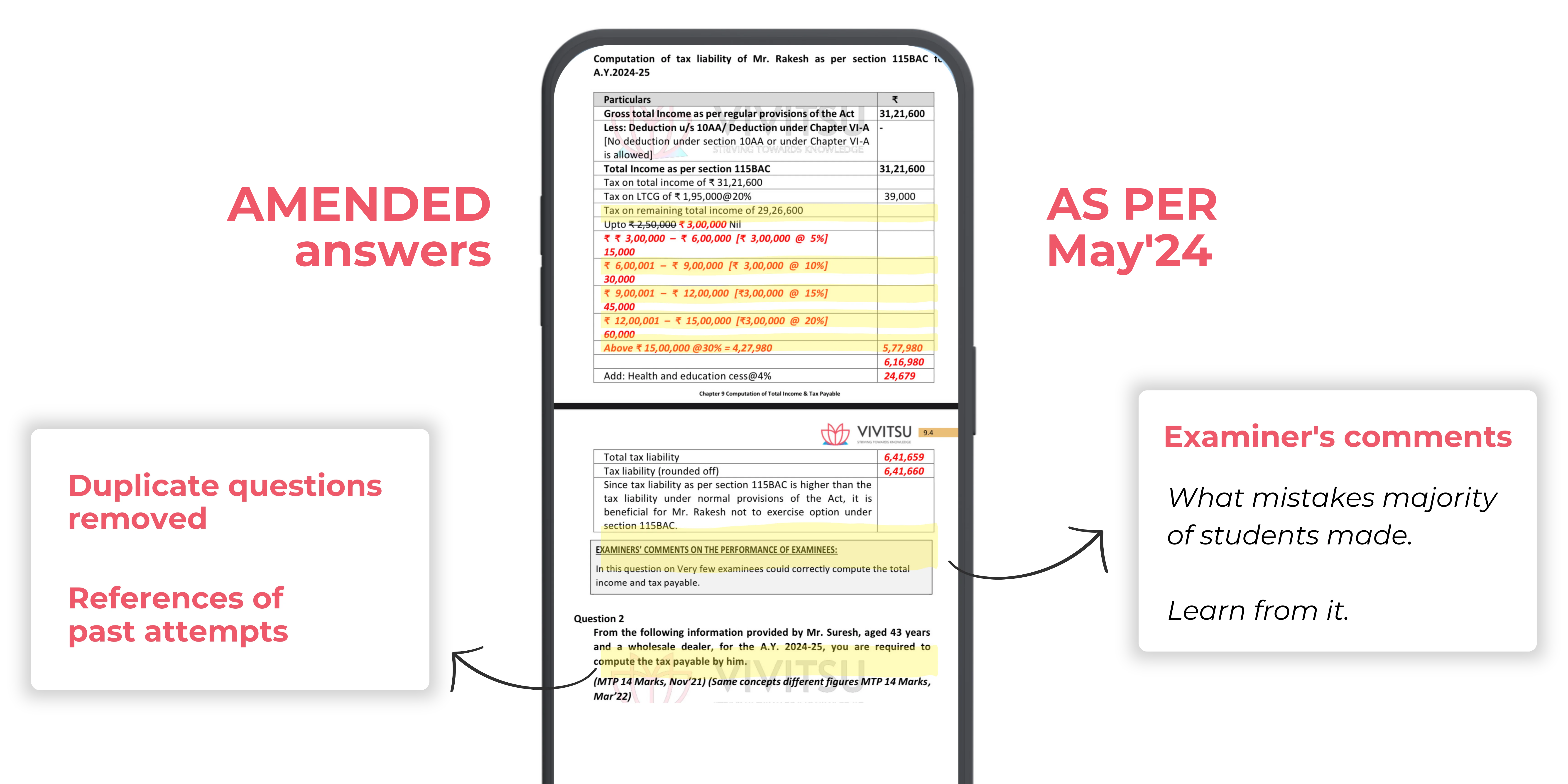

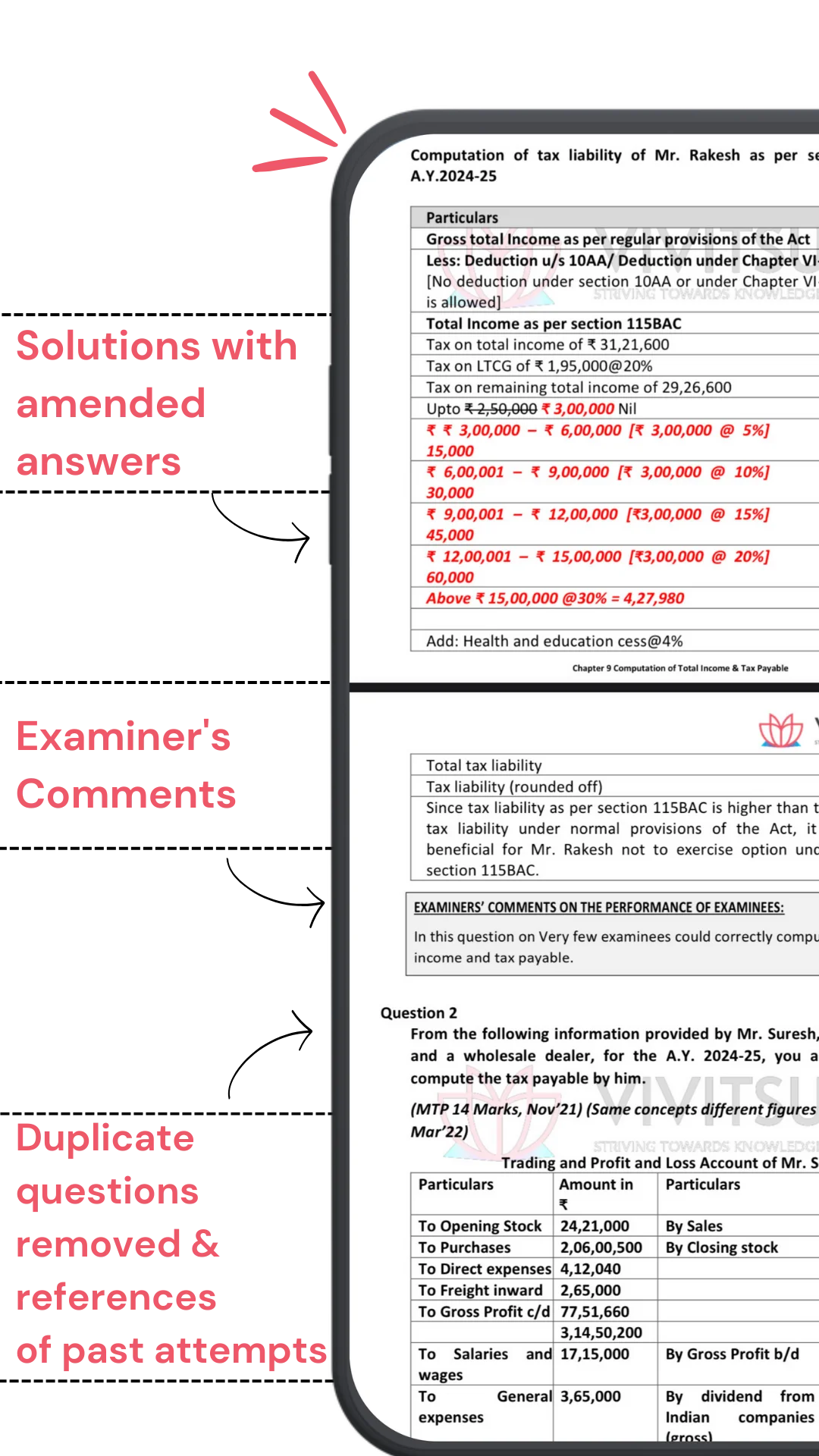

Free: Get PDFs for Nov'23 PYP

and May'24 RTP and MTP

in chapter-wise format

+

Free: Get PDFs for Nov'23 PYP

and May'24 RTP and MTP

in chapter-wise format

+

Free: Get PDFs for Nov'23 PYP

and May'24 RTP and MTP

in chapter-wise format

+

Free: Get PDFs for Nov'23 PYP

and May'24 RTP and MTP

in chapter-wise format

+

Free: Get PDFs for Nov'23 PYP

and May'24 RTP and MTP

in chapter-wise format

+

Free: Get PDFs for Nov'23 PYP

and May'24 RTP and MTP

in chapter-wise format

+

Free: Get PDFs for Nov'23 PYP

and May'24 RTP and MTP

in chapter-wise format

+

Free: Get PDFs for Nov'23 PYP

and May'24 RTP and MTP

in chapter-wise format

+

Free: Get PDFs for Nov'23 PYP

and May'24 RTP and MTP

in chapter-wise format

with Vivitsu's Compilation

with Vivitsu's Compilation

Vivitsu's Dashboard.